After more than a year, Brazil’s electric power watchdog Aneel held new energy tenders, but the results were disappointing, according to local experts and industry associations.

Only three distributors – Celpa, Cemar and Light – acquired power in the A-3 and A-4 auctions held last week. A total of 35TWh were negotiated through 20-30 year contracts starting in 2024 and 2025.

Most of the power contracted was based on wind (12.3TWh) from projects totaling 419.5MW of installed capacity. Hydroelectric undertakings amounted to 112MW selling 9.18TWh, while PV solar (269MW) and biomass plants saw 6.56TWh and 7.22TWh hired, respectively.

The previous energy tenders held by the regulator were the A-4 and A-6 auctions in 2019, where 17.5TWh and 250TWh were contracted. In 2020, only two auctions (A-1 and A-2 for existing energy plant tenders) were carried out amid the COVID-19 crisis.

“Very little energy was bought in total [in A-3 and A-4]. If we’re expecting a market recovery, the volume sold would have to be much larger,” Walfrido Ávila, the CEO of electricity trader Tradener, told BNamericas.

He added the outcome is an indication that the federal government should allow the participation of power traders in regulated auctions.

This year’s relatively low contracting levels, which were also seen in the A-4 and A-5 auctions for supply from existing plants, are possibly a reflection of a structural electricity over-contracting among power distributors in the regulated environment.

“The very low volume of contracting occurs because the distributors are projecting increased migration from the regulated market to the free market, as the free market is seen as reducing the cost of energy,” the president of Brazil’s small hydropower plants association Abrapch, Paulo Arbex, told BNamericas. “This doesn’t really happen. What happens is that the consumer that migrates to the free market leaves to the regulated consumer a series of costs related to the security of the system.”

According to Arbex, thermoelectric power plants in 2019, for example, received 10.7bn reais (US$2.07bn), which was entirely paid by the regulated market, even though the free contracting environment represents 35% of the market. “Opening the market without correcting this and several other distortions is a big problem.”

In a statement, the president of local wind power association ABEEólica, Elbia Gannoum, said that “although it was a small amount compared to previous auctions, we need to consider the economic scenario we are in and evaluate that we had a coherent result and were able to make a good number of projects viable for the moment.”

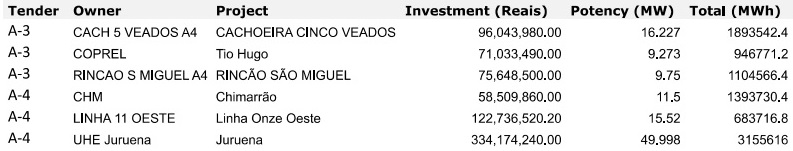

Wind projects hired

Source: BNamericas based on Aneel dataIn the view of Brazil’s solar energy association Absolar, the hiring of energy from the PV source should have received higher priority.

“If the federal government had contracted twice as much energy from the solar source in these two auctions, reducing the energy purchased from more expensive sources, it would have saved Brazilian consumers at least 126.8mn reais over the next 20 years,” said Rodrigo Sauaia, executive president of the entity.

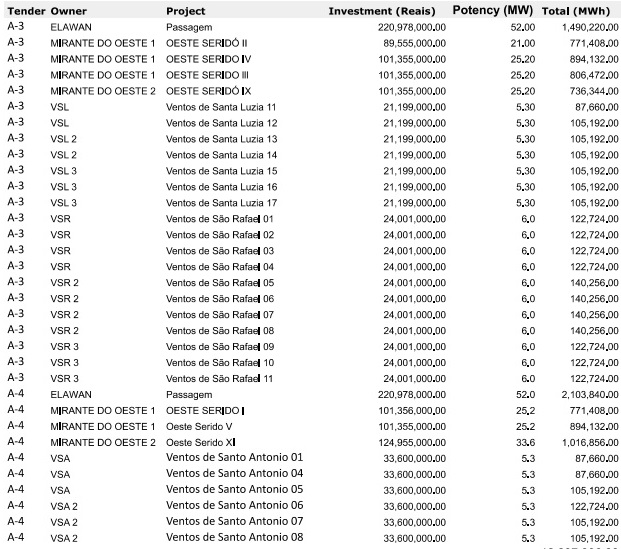

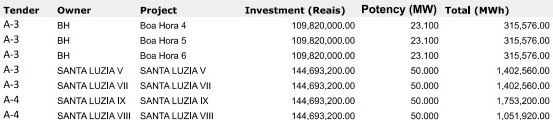

Solar power projects hired

Source: BNamericas based on Aneel data

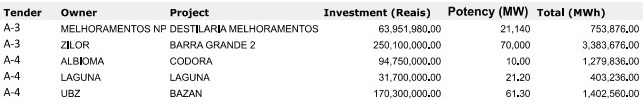

For the energy cogeneration industry association Cogen, the number of projects and the volumes contracted in the A-4 and A-3 auctions were well below the potential contribution that bioelectricity has to offer the country.

“Brazil is going through a worrying water crisis, with the level of water in the reservoirs of the hydroelectric plants of the southeast and central-west subsystem reaching, in early July, 28% of storage capacity,” said Cogen’s director of technology and regulation, Leonardo Caio Filho.

Biomass projects hired

Source: BNamericas based on Aneel data+

Matéria publicada no site BNAmericas.

12.07.2021

No comment